This is a talk I gave in Las Vegas last month at MicroConf 2015, a conference for self-funded entrepreneurs.

I’m Ted Pitts from Moraware. We make software for countertop fabricators. My business partner, Harry, and I started Moraware 12 years ago.

We track a few different metrics in our business: Recurring Revenue, Churn, etc. But the most important metric we use to make decisions isn’t talked about as much.

That is Profit.

You don’t hear as much about profit as a SaaS metric, for a few reasons:

The first is it doesn’t apply to startups. If you’re profitable and sustainable, you’re not a startup. You’re just a business.

The second reason is most of the blog posts about SaaS metrics are written by VC’s or VC-backed founders. VC’s are in the business of funding your losses so you can grow big. They don’t want you to be profitable at the beginning.

And third it’s really awkward to talk about profit. Half of you are gonna think I’m bragging about how much money we make, and the other half will think I’m a fool for making so little. But I’m going to talk about profit anyway.

First I want to be clear about what I mean by profit. Some of you might be thinking: “Well my hosting costs are really low, so almost everything I make is profit.”

That’s not what I mean by profit. If you’re spending time on your business and you make money from it, a lot of that money is really salary. Profit is what’s left over after you’ve paid yourself a market salary. Think about what it would cost to hire someone else to do everything you’re doing. What’s left over is the profit.

Some of you are building a business to replace your salary, and profit isn’t even on your mind yet. Should you care about being profitable? What’s wrong with just replacing your salary?

Here are two reasons you should think about profit:

First, profit is your margin for error. If you’re relying on your business for your salary, or maybe you have employees relying on you, if there’s no profit and there’s any kind of problem, it could really damage your business. That might be an economic recession, a new competitor, or even a change in Google’s search algorithm. All of these problems have happened to people in this room.

The second reason you should care about profit, is it gives you options. Some day you may not want to be doing the same work anymore. If you have a profit, you can pay someone else your salary to do the work, and use the profit to finance your next project.

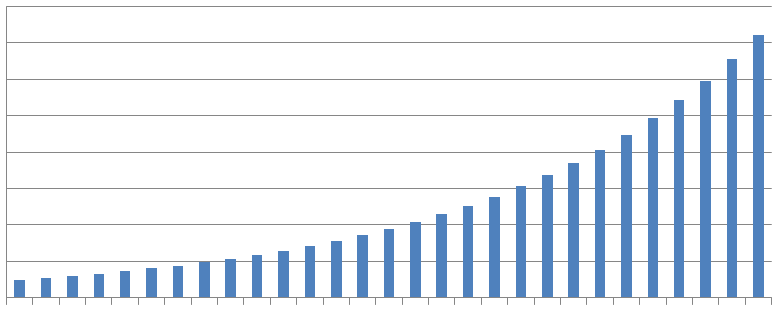

We’ve all seen this chart of SaaS revenue:

Getting your revenue to look like this is really difficult. But even after you’ve accomplished that, you still have to solve the additional problem of profitability.

It seems obvious that at the beginning you’ll lose some money, but sometime later on you’ll make big profits.

At what point does your company go from losing money to profit?

At the beginning, you don’t have a choice. But as your revenue grows, there comes a point where you have to make a decision about whether you’re going to spend that last thousand dollars, or keep it as profit.

You COULD keep spending more than you make and never make a profit.

How do you decide when to become profitable?

There was a great conversation about this issue on the Startup podcast. Alex Bloomberg was talking with his investor Chris Sacca about becoming profitable. Here’s what the VC had to say:

“That’s usually a bad move for an early stage company, to get cash flow positive. Everyone I know who’s pushed for cash flow positivity that early, stops growing at the rate they should be growing, and gets so anchored by this idea that we need to keep making money that they no longer feel the freedom to take the chances and spend the money they need, to be the size they need to be.” – Chris Sacca (Startup podcast Ep. 14)

In this case, Chris is telling Alex that since he took investor money, he now needs to build a big company. He’s not allowed to be small and profitable.

For those of us who are self-funded, we might choose something different.

If you haven’t really thought about this issue, you might assume “I should be as big as possible.” But that’s not true.

There are a few factors that will determine whether the last thousand dollars goes towards growth or profit.

There’s a minimum size just to be viable. Some of you can run your business just by yourself. At Moraware, we sell a mission-critical app to businesses. We need coverage when someone is on vacation or traveling. That means we need at least two people for sales and support, and another two for the software and servers. So two extroverts and two introverts is our minimum size.

Your market is a big factor. We’re in a small niche, so that puts an upper limit on the size we can be. On the other hand, Facebook can’t choose to be small. Someone else would take over the market.

Your goals also matter. Just as an investor can dictate you have to be large, you might choose to stay small to control your lifestyle. Or maybe you’re only interested in going big. My goal was to make sure I never have to work for anyone else again. Once we got there, my goals didn’t change – we’re happy where we are.

The opportunity for growth is one that you probably can’t know until you’re in the middle of it. If you can spend $1 and turn that into $5 of future profit, you’re going to do that as long as possible. But at some point you’ll run out of opportunities like that. Then it makes more sense to take the profit.

For example, when we started out, we went to big national trade shows, and it worked great. We’d spend $8000, and get $50,000 in sales. But as we went back to the same trade shows year after year, we kept seeing the same people, who were already customers. So it became less profitable over time. We eventually stopped going to those.

And finally, time comes into play in a couple ways. If your app is going to be obsolete in a year, you take the profit now. Or you may run out of patience. I’ve been at this for 12 years. I’d rather not defer the money for another 12 years.

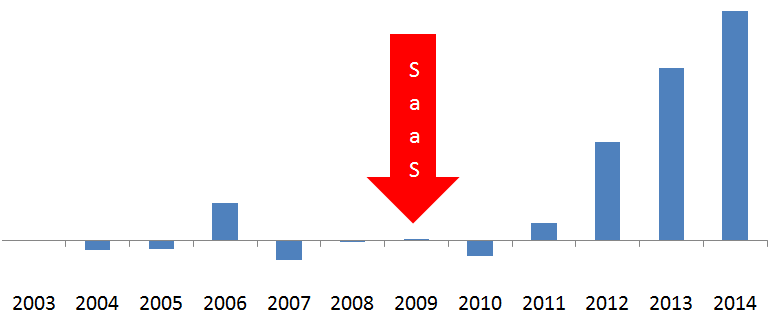

This is our actual profit over the past 12 years.

The first 9 years net out to zero. I know what you’re thinking. “How did you become profitable so quickly?”

We made a few mistakes along the way.

The biggest problem is we spent the first 6 years making one-time sales. We weren’t building up much recurring revenue. In 2009 we did a reboot and started selling subscriptions.

The left half of this chart is a one-time sales business model, the right half is a SaaS business. I prefer the SaaS business.

The other issue is our customers are in the home construction market. In 2006 we made a small profit, and thought we were on our way, but that was the peak of the housing bubble. The market turned down in 2007, and by 2008 it was a disaster. We had a lot of customers go out of business, and even the survivors often lost 75% of their revenue. So it was a tough time to sell them software.

Despite our mistakes, all bootstrapped companies look something like this. You spend the first years putting all your revenue back in the company, and then one day you start turning a profit.

Notice that all the profit is at the end! For those of you that love starting projects, but switch to something new every 3 years. You’re never going to get to the real money.

But even today, profit is not automatic. Money burns a hole in your pocket. It would be very easy for us to hire a bunch of people tomorrow, and the profit is gone.

To make sure we don’t screw it up, we decided on the most important metrics, and we try to keep these going in the right direction. These are the 3 metrics we use to make decisions:

- Revenue / Employee

- Profit

- Quality of life for all employees

80% of our expenses are employees. So hiring has a huge impact on profitability. The easiest way to make sure profit is going up is to make sure revenue per employee keeps going up. By targeting Revenue per Employee, we limit our hiring to be slower than our revenue growth.

We also track profit. We look at the dollar amount, but you might also look at this as % of revenue.

And the third metric is quality of life for all employees. This is another form of profit. We will take every opportunity to trade money for happiness. But that’s not always easy, so sometimes we just settle for the money.

Sometimes these metrics are aligned, and other times they compete with each other.

There are times that hiring a new employee is the best way to improve quality of life, even though it reduces the other two.

But increasing revenue per employee also allows us to increase salaries, which improves quality of life.

We do profit sharing, so increasing profit helps everyone.

And improving our internal processes often will reduce our need for more employees, and make our quality of life better at the same time.

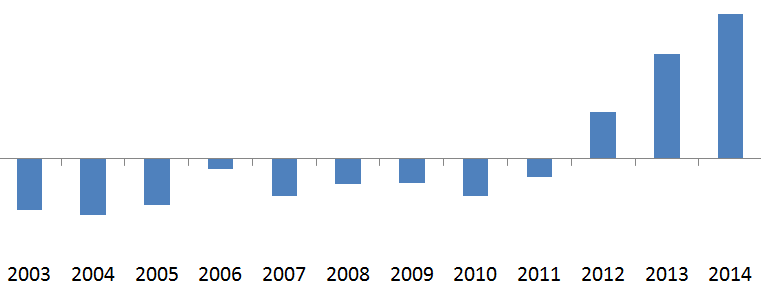

But that previous chart of profit was a lie! It’s not our real profit.

It said our first year we broke even. But Harry and I gave up 6-figure incomes to work full time on Moraware. And we didn’t pay ourselves any salary for two years.

That’s not breaking even. We were losing over $200,000 a year.

Here’s the real profit chart. This is what it would have looked like if Harry and I paid ourselves a market salary the whole time.

This chart has no correlation with my level of happiness over the years. We’ve had highs and lows along the way.

But I do look at profit as one of the factors to determine whether it’s worth all the extra hassle and stress to run your own business.

If you add up all the numbers, up to today, it comes out to ZERO!

Today is our break even day – 12 years in.

So tomorrow we’re finally gonna make a profit.